What does the Autumn Budget mean for the housing market?

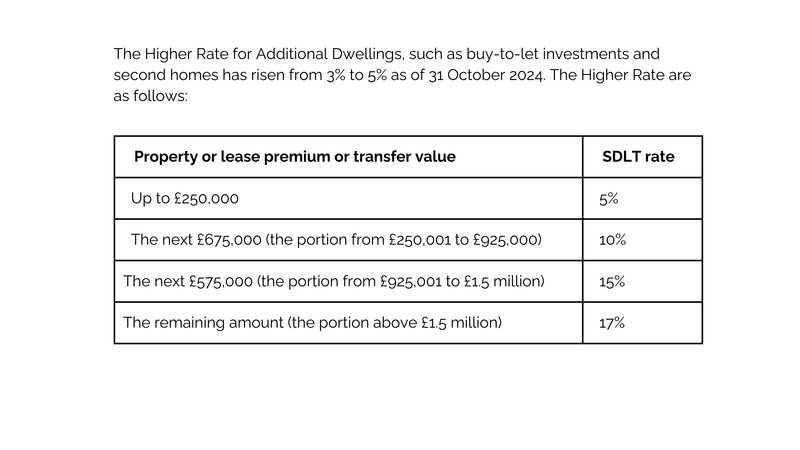

The Autumn Budget 2024 brought some key changes to Stamp Duty Land Tax (SDLT), especially for additional property buyers.

The move is likely to deter some investors from entering or expanding within the buy-to-let sector, potentially limiting rental supply but making room for more first-time buyers to enter the property market.

As for home movers, who have previously owned a property but will only own one property at the time of completion, the current Stamp Duty Rates will continue until the end of March 2025, which are as follows:

- Up to £250,000 - Zero

- The next £675,000 (the portion from £250,001 to £925,000) - 5%

- The next £575,000 (the portion from £925,001 to £1.5 million) - 10%

- The remaining amount (the portion above £1.5 million) - 12%

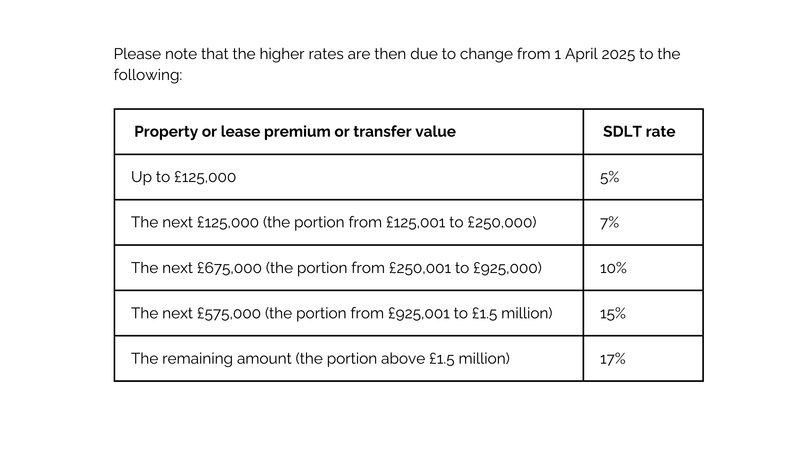

These rates will change from 1 April 2025 as follows:

- Up to £125,000 - Zero

- The next £125,000 (the portion from £125,001 to £250,000) - 2%

- The next £675,000 (the portion from £250,001 to £925,000) - 5%

- The next £575,000 (the portion from £925,001 to £1.5 million) - 10%

- The remaining amount (the portion above £1.5 million) - 12%

Key Take Aways

- Stamp duty increased to 5% on second homes from 31 October 2024.

- Higher stamp duty thresholds remain in place for first-time buyers and home movers until April 2025, but are set to be lowered in April 2025, (meaning the cost of stamp duty will rise for many people).

If you require any further information regarding Stamp Duty, please contact the Residential Conveyancing Team on 01924 387110.

Our Conveyancing Services

For more information or an online conveyancing quote, see here:

Residential Property Conveyancing